Designing Trusted Ecosystem

We build software product suites for an enterprise and power them with Blockchain to Digitally Infuse Trust & Future Proof Businesses Of All Size.

Our Partners & Customers

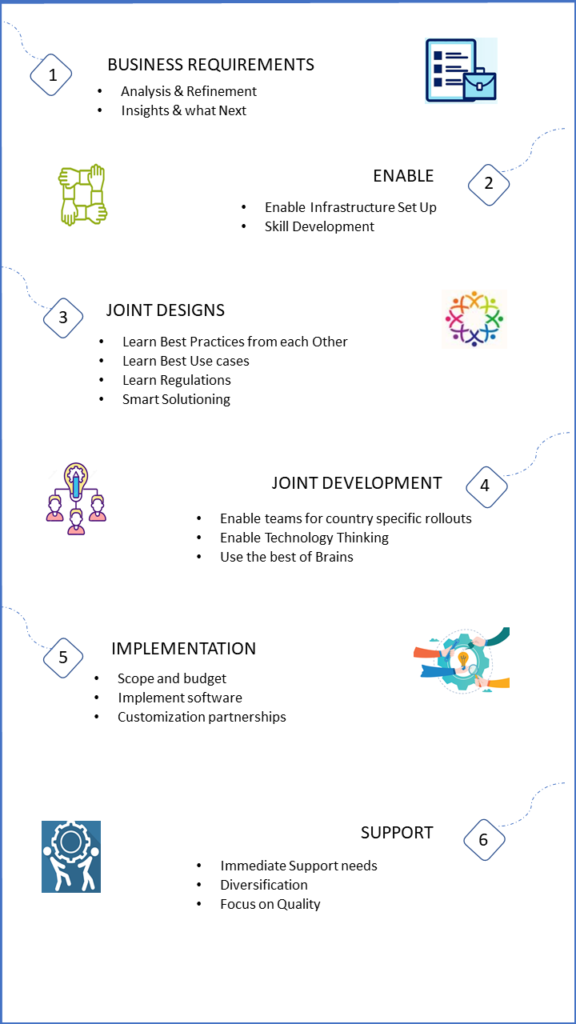

This IS How We Enable

Our Customers

Our Partners

Our Offerings

Legit-Mate

Intuitive application for Rule based and Behaviour based Compliance - Cyber Realm Lab

LC Tuple

Customer facing application to transparently track Letter of Credit based asset linkages

Blockchain Advisory

Consultation on best practices, Institutions needs/ Orientation of implementing Blockchain

Cybersecurity Advisory

Consultation on best practices, Institutions needs/ Orientation for latest security trends

About Us

Cyber Realm Labs (CRL) is a budding organization started in Bangalore, India by a bunch of passionate engineers with having decade long experience in Banking software and half a decade in emerging technologies in the areas of Blockchain and cybersecurity. Cyber Realm Labs aims to build a self-sustaining ecosystem and is on a mission to mutually grow along with other participants, and regional partners by increasing transparency & reducing carbon footprints. We have built world-class software and powered them with the capability of Blockchain. We aim to implement this software in the financial industry and showcase the best use of digital transformation by helping Institutions with knowledge enrichment and deeper market penetration.

02 Years Experience

2000+ Open APIs

We build software product suites for an enterprise and power them with Blockchain to Digitally Infuse Trust & Future Proof Businesses Of All Size.

Cyber Realm Labs Office

- Celino

-

Junnasandra, Sarjapura Main Road

Bangalore, India - +91-9620878188

- Query (shivendra@cyberrealmlabs.com)

Subcribe Our Newsletter

© 2023 Cyber Realm Labs. All Rights Reserved

Designed By Gladias